If you work in construction, you’ve probably heard of AIA billing and QuickBooks. But if you’ve ever tried to make them work together, you know it’s not easy.

Many general contractors and subcontractors face this problem: AIA billing is built for construction, but QuickBooks is built for general accounting. They speak different languages. That creates delays, mistakes, and headaches—especially when you’re trying to get paid on time.

In this post, we’ll break it all down in plain English. You’ll learn:

- What AIA billing is and how it works

- What QuickBooks does well (and what it doesn’t)

- Why these systems don’t work well together out of the box

- Real-world stats that show the impact

- 4 simple ways to bridge the gap—without buying expensive software

What Is AIA Billing?

AIA Billing is a standard way to ask for payment in construction.

It shows what work is done and how much is owed. Contractors use it to send clear, trackable invoices. Owners use it to double-check before paying. It keeps both sides on the same page.

The American Institute of Architects (AIA) created it. Why? Because billing used to be messy. Everyone used different forms. Owners didn’t trust what they saw. Contractors didn’t get paid on time.

AIA fixed that with standard documents. Everyone now speaks the same billing language.

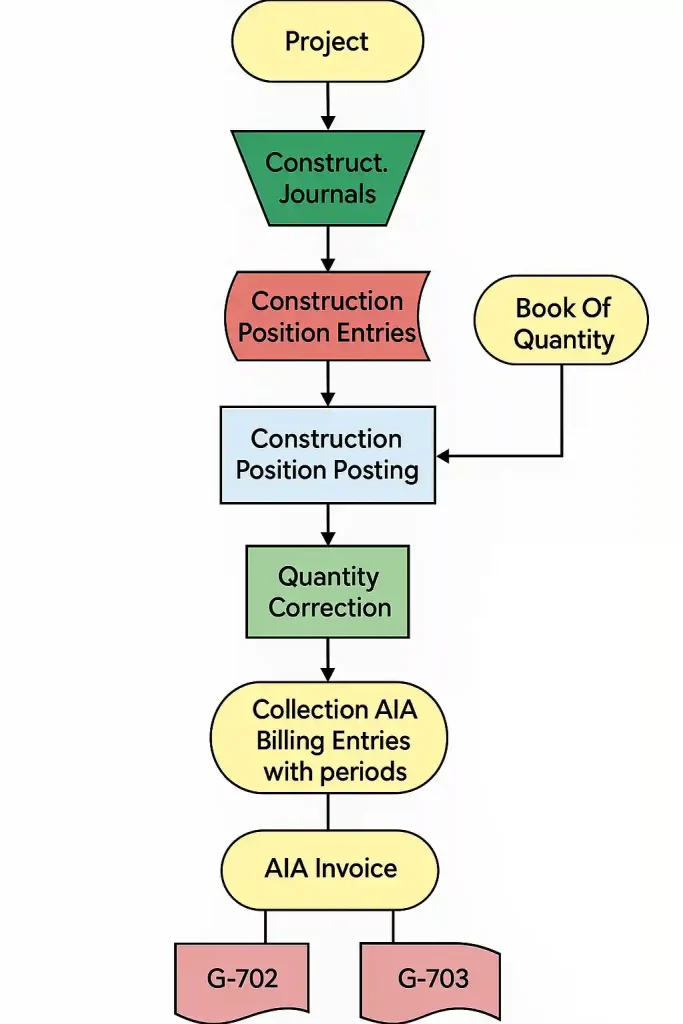

You fill out two main forms:

- One shows the total money owed (G702).

- The other breaks down the work done, line by line (G703).

These forms plug right into your contract. They track changes, progress, and retainage. That means fewer fights, faster payments, and clear paper trails.

AIA Billing works because it’s simple, fair, and organized.

But only if you do it right.

AIA Billing Contract Documents

AIA billing comes from the American Institute of Architects. It uses two main forms:

- G702: The G702 form, officially called the Application and Certificate for Payment, serves as the summary page of the pay application. It shows the overall financial picture of the job, including the original contract amount, any approved change orders, the total value of work completed to date, the retainage held, and the total amount requested for payment in the current billing cycle.

It also tracks previous payments and calculates what is still owed. At the bottom of the form, there is a section for the contractor to certify the request and for the architect or owner to approve the payment. This form is essentially the “invoice” presented for approval—it answers the high-level question: how much should be paid right now?

- G703: The G703 form is known as the Continuation Sheet. It provides the detailed breakdown that supports the numbers shown in the G702. It lists each item from the project’s schedule of values—like excavation, concrete, framing, or finishes—and shows the value of each, how much of that work has been completed, what was billed in previous periods, what’s being billed this period, any materials stored on-site, and the amount of retainage withheld.

The G703 connects the dollars to actual progress made on the jobsite. It’s the backup that proves what’s been done and justifies the payment request on the G702.

These forms are standard on many commercial jobs. Owners and architects love them because they’re detailed and consistent. But filling them out takes time. They ask for:

- Original contract amount

- Change orders

- Percentage of work done

- Retainage (money withheld)

- Stored materials

- Total earned to date

You don’t just send an invoice. You prove your progress—and back it up with numbers.

| Construction Budget 101:How to Stop Bleeding Cash on Every Job – Read More |

What QuickBooks Does (and Doesn’t Do)

QuickBooks is great at:

- Tracking income and expenses

- Handling payroll and taxes

- Creating standard invoices

- Producing financial reports

But QuickBooks is not built for construction billing. It can’t natively create G702 or G703 forms. You can set up progress invoices, but you won’t get:

- Line-by-line breakdowns by cost code

- Easy retainage tracking

- Stored materials sections

- Certified pay apps that match AIA formats

So, you’re stuck doing this:

- Manage billing in QuickBooks

- Build AIA pay apps manually in Excel

- Hope the numbers match

- Re-check everything if there’s a mistake

It’s a mess. And it takes time.

The Real Cost of the Gap

Let’s break it down with numbers:

- According to CFMA (Construction Financial Management Association), the average contractor spends 6–10 hours per week managing billing and pay apps.

- 75% of contractors say billing errors or slow approvals cause delays in payment, according to a 2023 Procore report.

- Late or rejected pay apps lead to average payment delays of 40–60 days in commercial construction (Levelset, 2022).

In short: If your AIA billing doesn’t match your books, you get paid late.

And when you get paid late, everyone downstream suffers—from vendors to payroll to your own subs.

| Construction Cost Estimation: A Clear Guide for Every Builder – Read More |

4 Simple Ways to Bridge the Gap

You don’t need a giant system overhaul. You just need the right tools and workflow to close the gap between QuickBooks and AIA billing.

Here’s how:

1. Use an AIA-Compatible Template That Syncs With QuickBooks

Start with a smart Excel-based G702/G703 template that lets you:

- Import your cost codes from QuickBooks

- Auto-calculate retainage and stored materials

- Match QuickBooks line items with AIA-style billing

Some templates even allow export/import to CSV so you can update data easily. If you bill once a month, this saves hours and reduces copy-paste errors.

🛠 Tip: Lock your formulas so only data entry areas are editable. This helps reduce math errors when different team members fill it out.

2. Set Up QuickBooks for Construction Billing

QuickBooks has some useful features—but only if you set them up right.

✅ Use progress invoicing

✅ Enable job costing

✅ Create customer: job for each project

✅ Assign items or cost codes that match your schedule of values

✅ Track retentions as separate receivable items

When your setup mirrors your AIA billing format, it’s easier to match totals and avoid errors.

🧠 Quick Tip: You can use “Subtotal” items in QuickBooks to group line items by division or CSI code—just like the G703 continuation sheet.

3. Track Change Orders Separately (But Clearly)

One of the biggest pain points in AIA billing is matching approved change orders to your current billing cycle. QuickBooks can track them, but it’s easy to miss if you don’t flag them clearly.

✅ Create a “Change Orders” section in your AIA G703

✅ Match it to a separate line in QuickBooks

✅ Update both when the change order is approved—not just when it’s signed

Bonus tip: Always include a running total of “original contract + approved changes” at the top of your AIA G702.

4. Use a Simple Middleware Tool (If Needed)

If you manage multiple jobs or have high billing volume, it may be worth using a connector or third-party tool. Some popular choices include:

- Knowify

- Foundation Software

- Deltek

Many of these tools:

- Integrate with QuickBooks Online or Desktop

- Auto-generate G702/G703 forms

- Track retainage and stored materials

- Manage sub pay apps too

You don’t need a huge ERP. A lightweight tool that bridges QuickBooks and AIA billing can pay for itself quickly—especially if it saves you from missing a billing deadline.

AIA billing and QuickBooks serve two different worlds—but your business has to live in both.

You want:

- Clean, accurate QuickBooks records

- AIA pay apps that get approved fast

- Fewer billing mistakes

- Faster payments

That only happens when your billing team and accounting team are in sync. Whether you use a smart Excel file, tweak your QuickBooks setup, or bring in a light tool, bridging the gap doesn’t need to be hard—or expensive.

And remember: The better your billing, the faster you get paid.

How MetaConstructX Bridges the Gap for You

If you’re tired of chasing down numbers, double-entering data, or worrying about billing delays—MetaConstructX takes that off your plate.

Here’s how it helps:

✅ Auto-Fills G702/G703 Pay Apps

MetaConstructX pulls real-time cost data from your schedule of values and updates your AIA forms automatically. No more Excel juggling. Just review and send.

✅ QuickBooks Sync That Makes Sense

Whether you use QuickBooks Online or Desktop, MetaConstructX maps your cost codes and progress billing into AIA formats. It keeps your books clean and your billing team sane.

✅ Built-in Retainage, Stored Materials, and CO Tracking

Track retainage, stored materials, and change orders—without manual workarounds. Everything connects and updates in one place.

✅ One Dashboard, All Projects

You see where every job stands—how much is billed, how much is left, and what’s holding up payments.

✅ Audit-Ready Billing Records

Every pay app is stored, timestamped, and linked to its backup. That makes it easy to answer any payment question in seconds.

No more missed billing deadlines. No more rejections. Just clean, fast, accurate pay apps—every time.

Want to see how it works on your current jobs?

[Schedule a 15-minute demo of MetaConstructX →]